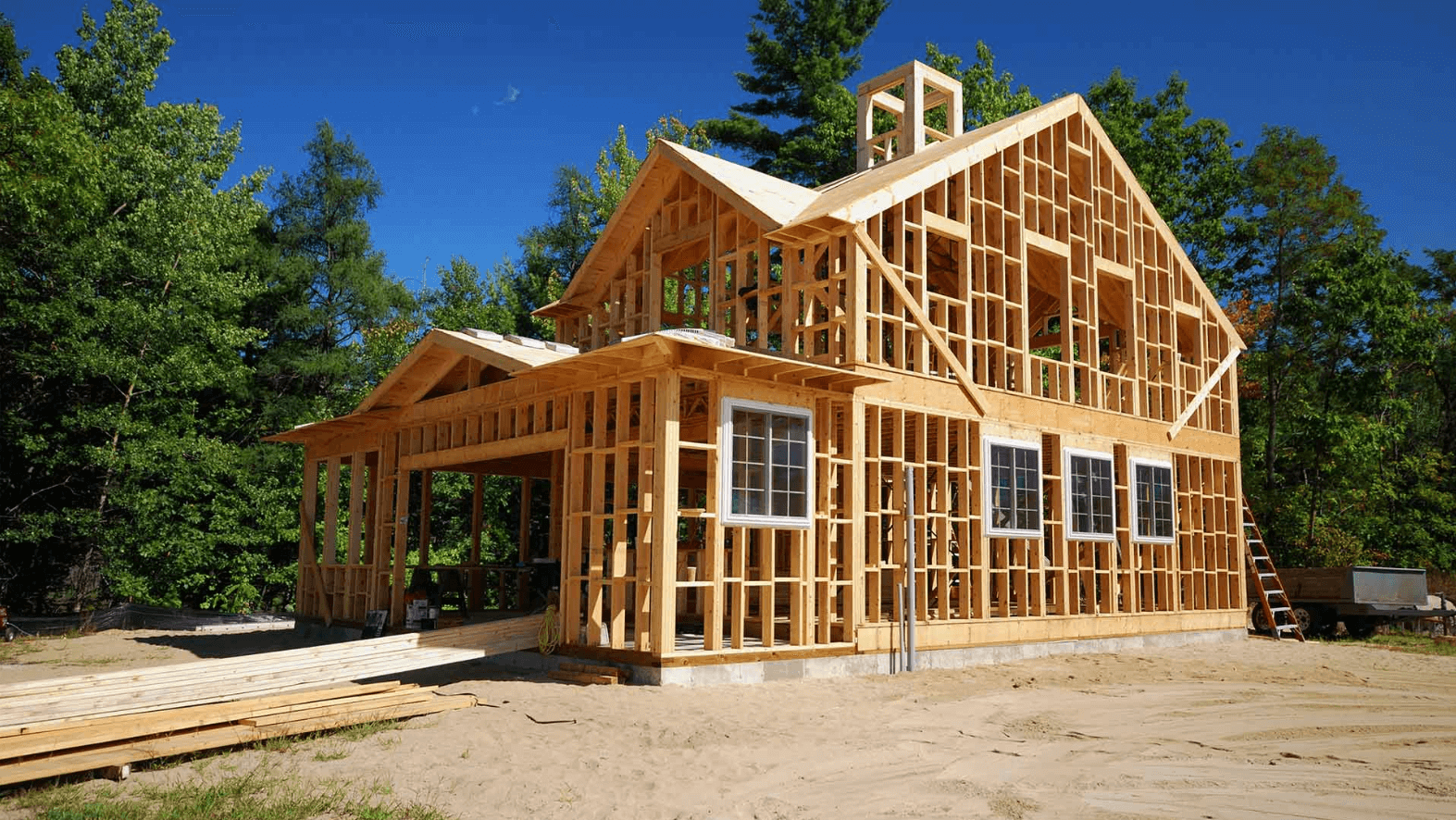

If you’ve ever dreamt of building your own home, the USDA construction loan might just be the financial tool you need to turn that dream into reality. USDA loans, primarily known for assisting homebuyers in rural areas, offer a unique subset tailored for those looking to construct their homes.

Understanding USDA Eligibility Criteria

To embark on this journey, it’s crucial to grasp the eligibility criteria. From income requirements to location-based qualifications, understanding the nuances will set you on the right path.

Benefits of USDA Construction Loans

Why choose a USDA construction over conventional options? Low-interest rates, zero down payment, and extended repayment terms are just a few of the compelling reasons.

Application Process for USDA Construction Loans

Uncover the step-by-step process of applying for a USDA loan, from the necessary documentation to the timeline for approval. We’ll also address common challenges and provide strategies for overcoming them.

Selecting a USDA-Approved Lender

Choosing the right lender is paramount. We’ll guide you through the importance of selecting a USDA-approved lender and offer tips on researching and comparing your options.

Navigating the Building Process with USDA Loans

Building a home involves collaboration with builders and adherence to USDA inspections. Learn how to navigate the construction process seamlessly with a USDA loan.

Tips for a Successful Construction Loan Experience

Success lies in meticulous financial planning, effective communication with lenders, and staying informed throughout the process. Discover essential tips for a smooth experience.

Potential Challenges and How to Mitigate Them

Delays in construction, unexpected financial changes – we address common challenges associated with USDA construction loans and provide practical solutions.

Comparing USDA Construction with Other Options

Versus traditional construction loans. Understand the key differences in terms and conditions before making a decision.

Real-Life Success Stories

Read inspiring accounts of individuals or families who successfully realized their homeownership dreams through USDA loans.

Addressing Common Misconceptions

Clear up misunderstandings surrounding construction loans. We’ll debunk common myths and provide accurate information to guide your decision-making.

Future Trends in USDA Construction Loans

Stay ahead of the curve by exploring potential future trends in USDA loans, including policy changes and adjustments in interest rates or eligibility criteria.

Case Studies: Completed Projects

Delve into case studies showcasing completed projects funded by construction loans. Real-world examples highlight the success stories made possible by this financing option.

Ensuring Compliance with USDA Regulations

Stay on the right side of the law by understanding and adhering to USDA guidelines. Learn about the potential consequences of non-compliance and how to avoid them. Read more…

Conclusion

In conclusion, USDA construction loans offer a pathway to homeownership that combines affordability and flexibility. If you’re considering building your dream home, exploring the possibilities with a USDA loan could be the key to unlocking your housing aspirations.

Frequently Asked Questions

- Can I use a USDA construction loan in any location?

- USDA construction are designed for specific rural areas. Check the USDA eligibility map to determine if your desired location qualifies.

- What sets USDA loans apart from traditional options?

- Unlike traditional loans, USDA loans offer low-interest rates, no down payment, and extended repayment terms, making homeownership more accessible.

- How long does the approval process for a USDA loan typically take?

- The approval timeline varies, but on average, it can take several weeks. Ensure all required documentation is in order to expedite the process.

- Can I choose any builder for my home with a construction loan?

- Builders must be USDA-approved, so it’s essential to collaborate with professionals familiar with the USDA guidelines for construction.

- What happens if there are delays in the construction process?

- Delays can occur, but effective communication with your lender and builder can help navigate and mitigate any issues that may arise.