If you’re in the United Kingdom and considering purchasing a home, you’ve likely come across the term “Bank of England Mortgage.” This article will delve into the world of mortgages offered by the Bank of England, the UK’s central bank. We’ll explore the institution’s history, mortgage services, application process, etc.

Understanding the Role of the Bank of England

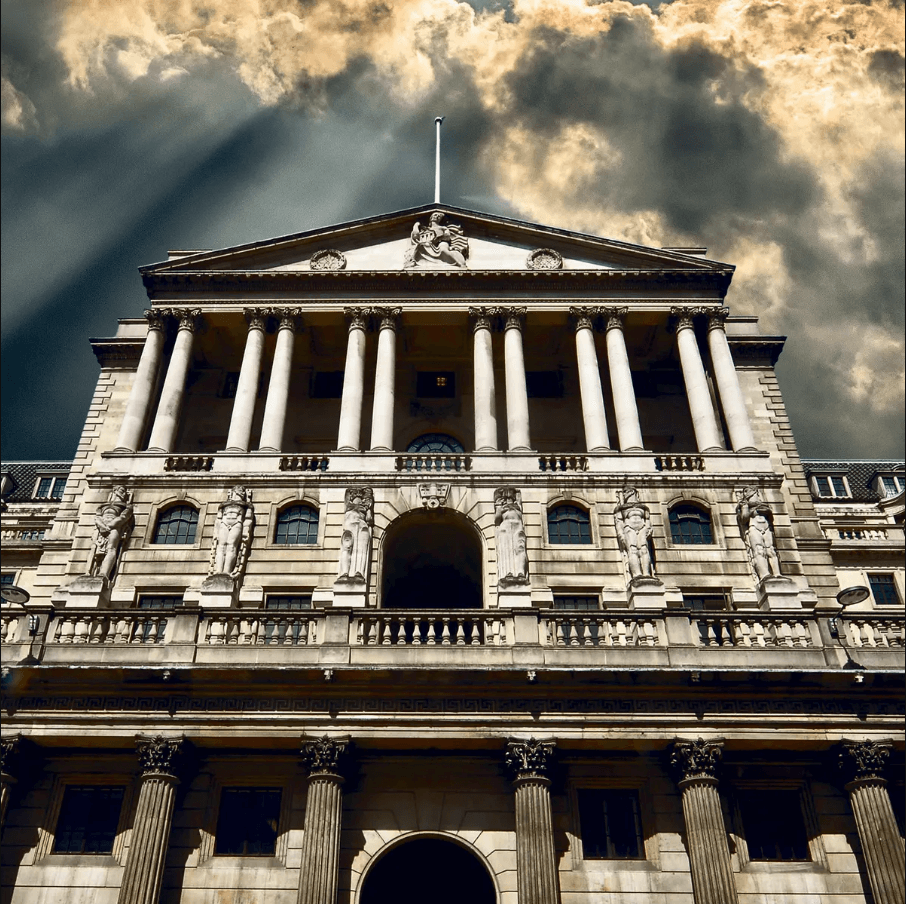

England, often called the “Old Lady of Threadneedle Street,” is the United Kingdom’s central bank. It is vital in managing the country’s monetary policy and promoting economic stability. Among its many functions, England also offers mortgage services to the public.

The History and Evolution of the Bank of England

Before we dive into the details of its mortgage offerings, let’s take a step back in time. The Bank of England boasts a rich history dating back to 1694 when it was founded. Over the centuries, it has evolved to become the influential institution it is today.

Bank of England Mortgage Services

Types of Mortgages Offered

The Bank of England provides a range of mortgage options to suit the diverse needs of UK residents. Whether you are a first-time buyer or looking to remortgage your property, they have solutions for you.

Interest Rates and Terms

Understanding the interest rates and terms associated with a mortgage is crucial. We’ll explore how the Bank of England sets its rates and what this means for mortgage applicants.

How to Apply for an England Mortgage

Getting started with an England mortgage is a straightforward process. We’ll guide you through the application steps, ensuring you have a clear path to homeownership.

Eligibility Criteria for Mortgage Applicants

Not everyone may qualify for a Bank of England. We’ll discuss the eligibility criteria, helping you determine if you meet the requirements.

Benefits of Choosing the England for Your Mortgage

Discover the advantages of opting for an England mortgage. From competitive rates to the institution’s commitment to financial stability, several benefits exist.

Alternatives to the England Mortgage

While the Bank of England is a reputable institution, exploring alternative mortgage options available in the UK market is essential. We’ll provide an overview of some viable alternatives.

Tips for Successful Mortgage Applications

Securing a mortgage is a significant financial decision. We’ll offer practical tips to increase your chances of a successful mortgage application with the Bank of England.

Customer Reviews and Testimonials

Hearing from those who have experienced the England mortgage process firsthand can provide valuable insights. We’ll share some customer reviews and testimonials to give you a well-rounded perspective.

The Future of the England Mortgage

What does the future hold for the Bank of England and its mortgage services? We’ll discuss the institution’s role in shaping the UK’s housing market.

Financial Stability and the Bank of England

Understand the critical role the Bank of England plays in maintaining financial stability within the country and its impact on the mortgage market.

Frequently Asked Questions (FAQs)

What is the history of the Bank of England?

The Bank of England’s history dates back to its establishment in 1694. It has evolved over the centuries and is now the UK’s central bank, playing a vital role in its economic stability.

How does the England impact the UK economy?

The Bank of England influences the UK economy by setting interest rates and implementing monetary policies that aim to maintain stable prices and financial stability.

What types of mortgages does England offer?

The Bank of England offers a range of mortgage products, including fixed-rate mortgages, variable-rate mortgages, and more. They cater to various homeowner needs.

How can I apply for a Bank of England mortgage?

Applying for a England mortgage is a straightforward process. You can start by visiting their website, filling out an application, and providing the necessary documentation.

What are the advantages of choosing the Bank of England for a mortgage?

Choosing the England for your mortgage has advantages like competitive rates, financial stability, and a history of responsible lending.

In conclusion, the Bank of England Mortgage provides a viable path to homeownership in the UK. With a rich history and a commitment to financial stability, it’s a reputable choice for those seeking a mortgage. Explore your options, consider the eligibility criteria, and make an informed decision about your home financing.